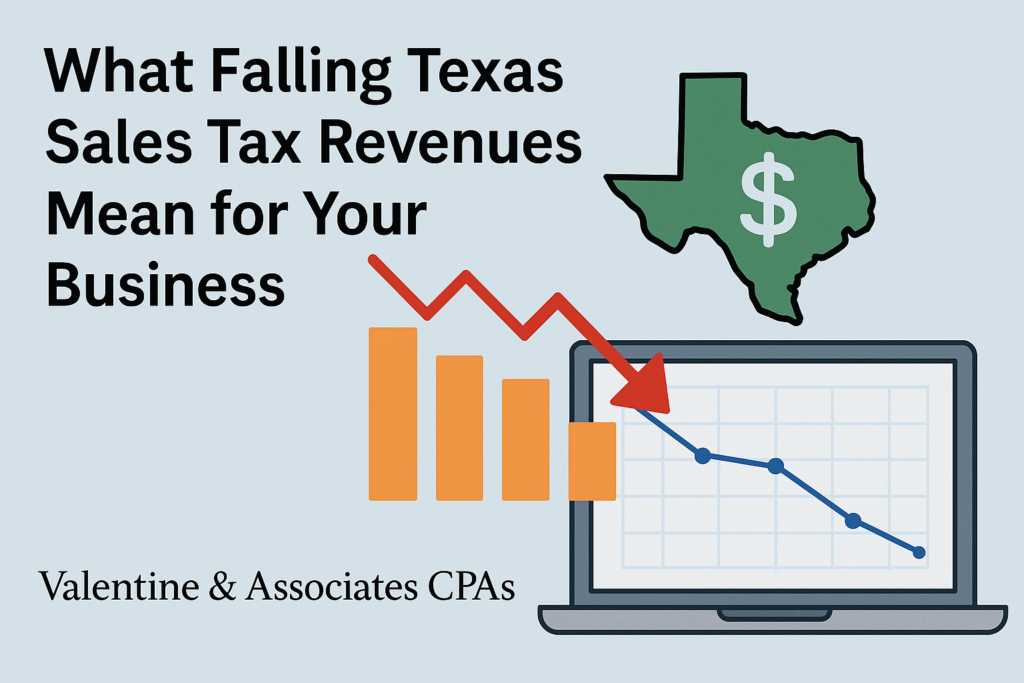

What Falling Texas Sales Tax Revenues Mean for Marble Falls Businesses — And How a Local CPA Firm Can Help

Share On Social

Recent data from the Texas Comptroller’s Office revealed a notable trend: state sales tax revenues for March 2025 totaled $3.68 billion, a 2.7% decline compared to the same period last year. While this might seem like a statewide issue, the ripple effects are very real for businesses in Marble Falls, TX — especially small and mid-sized companies that are already navigating tight margins and evolving tax requirements.

In this post, we’ll explain what this sales tax dip means, how it could impact your business locally, and how the team at Valentine & Associates CPAs can help you adapt through smart tax planning, compliance, and strategic advisory services.

Understanding the Decline in Texas Sales Tax Revenue

The Texas Comptroller’s latest report showed a downturn across several key industries:

- Construction experienced double-digit decreases in taxable sales.

- Retail sales saw continued softness as consumer spending tapered.

- Wholesale trade and manufacturing both reported year-over-year declines.

Interestingly, some areas such as technology and data processing services continued to grow, indicating a shift in economic activity toward digital sectors.

So, what does this mean for businesses in Marble Falls and Burnet County?

What This Means for Local Businesses

While macroeconomic trends may seem distant, they have very real implications for your local operations. A drop in sales tax revenue often reflects broader economic slowdowns or shifts in consumer behavior — both of which can affect everything from staffing to inventory decisions.

Some potential impacts on local businesses include:

- Closer scrutiny from tax authorities as the state looks to tighten enforcement to recover revenue.

- Shifting consumer demand that may affect your cash flow projections and sales targets.

- Changes in local or regional tax policies, such as incentive programs or adjustments to sourcing rules for sales tax.

If your business sells goods or services subject to Texas sales tax, now is a critical time to review your compliance, forecasting, and reporting practices.

Visit us at va-cpas.com or call our Marble Falls office today to learn how we can support your business growth in 2025 and beyond.

How Valentine & Associates CPAs Supports Marble Falls Businesses

Located right here in Marble Falls, Valentine & Associates CPAs understands the unique challenges facing Hill Country businesses. We offer a full range of accounting and tax services that are specifically designed to help local business owners stay resilient and financially sound — even during periods of economic uncertainty.

Sales Tax Compliance and Reporting

Texas sales tax laws are complex and always evolving. Our firm helps ensure that you are properly collecting, remitting, and documenting sales tax in full compliance with state rules. We also stay ahead of new sourcing changes that could affect where your sales tax is owed.

Cash Flow Forecasting and Budgeting

In light of declining state revenues, it’s more important than ever to build flexible, data-driven forecasts. We work with business owners to create budgets and cash flow projections that reflect real-time economic trends and help plan for any potential slowdowns.

Industry-Specific Accounting Services

Whether you operate a construction company, retail shop, or professional service firm in Marble Falls, our accounting solutions are tailored to your specific industry. We understand the nuances of local market conditions and apply that knowledge to your financial strategy.

Proactive Tax Planning

We monitor legislative changes at both the state and federal levels. Whether it’s a new franchise tax rule, local sourcing amendment, or an upcoming filing deadline, we help you plan ahead — not react at the last minute.

Serving the Heart of the Hill Country

Valentine & Associates CPAs proudly serves clients across Marble Falls, Burnet, Horseshoe Bay, Granite Shoals, and surrounding communities. We’re more than just tax preparers — we’re long-term partners in your business success.

As state tax policies shift and the economy continues to evolve, don’t leave your business exposed. Work with a local accounting team that understands both the numbers and the neighborhood.

Schedule a Consultation Today

If you want to ensure your business is ready for what comes next — from tax compliance to financial strategy — we invite you to schedule a consultation with Valentine & Associates CPAs.

Visit us at va-cpas.com or call our Marble Falls office today to learn how we can support your business growth in 2025 and beyond.